Richard Cayne at Meyer International Ltd in Bangkok Thailand recently compiled a top 10 list of wise investing aphorisms that distill the knowledge he has gathered from many years in the markets and the financial industry. Several are insights into human psychology or historical facts and figures.

1. Richard Cayne explains how a broad index of U.S. stocks increased 2,000-fold between 1928 and 2013, but lost more than 20% of its value 20 times during over that same period. People would be less scared of volatility if they knew how common it is. Investors would be advised to learn and understand the concepts of randomness and the behavior of random as they would then be much better equipped to understand the finance world than someone who naively thinks in purely straightforward terms. In fact, the more informational efficient financial markets are, the more unpredictable their movements may be.

2. Timing the market is a fool’s game, however time in the market is your greatest natural advantage. Try to remember this the next time you’re compelled to sell your holdings. The fact is that chasing returns is a killer for the average investor.

3. According to Vanguard, over 70% of mutual funds benchmarked to the S&P 500 underperformed the index over a 20-year period ending in 2010. The phrase “professional investor” is a relatively loose one. Investors should all know this point and why the respective manager stands a chance at outperformance explains Richard Cayne. Finance professionals have been shouting about this for decades.

4. According to Bank of America, 40% of stocks have suffered “major losses” since 1980, meaning they fell at least 70% and never recovered. Therefore the idea that stocks move in unpredictable ways isn’t surprising.

5. Our memories of financial history seem to extend about a decade back only. “Time heals all wounds,” the saying goes. It also erases many important lessons. Major financial crises are soon forgotten and in a few more years perhaps the recent one from 2007-2009 will be forgotten. That said hyperinflation from 70’s and 80s is long forgotten and would be advisable to re acquaint with as this may soon be back with us in the coming years after all QE has been said and done.

6. The most boring companies such as in pharmaceuticals, soap and building materials can make some of the best long-term investments. The most innovative can be some of the worst. Just look back over outperformance of value stocks over glamor stocks over the past 30 years.

7. If all the investors try to beat the market, a lot of effort will be wasted. But if none of them try to beat the market, the market won’t be a useful aggregator of information. The solution is to have true experts dig up new knowledge and make money doing it, while everyone else invests into index funds and ETFs and just goes along for the ride.

8. According to University of Oregon economist Tim Duy, “As long as people have babies, capital depreciates, technology evolves, and tastes and preferences change, there is a powerful underlying impetus for growth that is almost certain to reveal itself in any reasonably well-managed economy.”

This is great advice but it’s also a reason not to invest in stocks in Japan, where population is shrinking and productivity has stalled. If looking at economic fundamentals, it might not be so surprising that the Japanese stock market has been in decline for more than two decades and only recently signs of emerging.

9. The single best three-year period to own stocks was during the Great Depression. Not far behind was the three-year period starting in 2009, when the economy struggled in utter ruin. The biggest returns begin when most people think the biggest losses are inevitable and the prospects look the dreariest. Long-run predictability is one of the most interesting facts discovered by finance researchers in the last few decades. You can indeed make a little extra money by buying stocks when they are cheap and selling when they are expensive. However it is important to remember that this may not always work.

10. Several academic studies have shown that those who trade the most earn the lowest returns. Fees often also erode return potential so important not to keep buying and selling as the fees will keep chipping off your bottom line return.

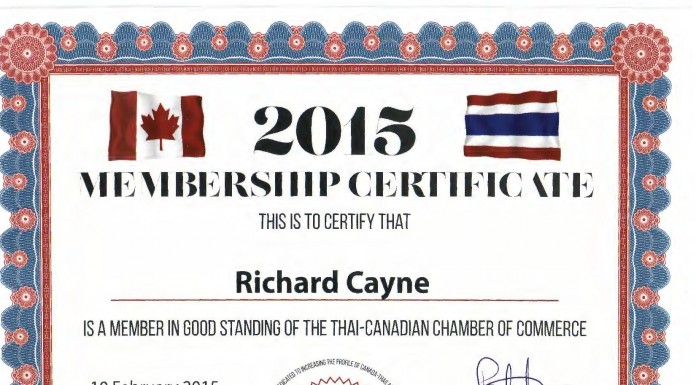

Richard Cayne, native of Montreal, Quebec Canada currently resides in Bangkok Thailand with his wife Akiko Cayne and their two children and runs the Meyer Group www.meyerjapan.com and is also CEO of Asia Wealth Group Holdings Ltd a London, UK Stock Exchange listed Financial Holdings Company. Prior to Bangkok he was residing in Tokyo Japan for over 15 years.

Richard Cayne has been involved in wealth management in Asia for over 19 years and has assisted many High Net worth Japanese families create innovative international tax and wealth management planning solutions. The public company of which he is CEO can be seen at

www.asiawealthgroup.com or stock exchange link https://www.isdx.com/Asia Wealth Group