In the wary world of the market, money market funds are a popular way to invest your money in a relatively safe way usually for short term. Used by both individuals and businesses, money market accounts are used as a short-term cash management tool. For the most part, money market funds are designed as a short-term investment (less than one year); many accounts mature in 30-90 days. There are some money market accounts designed to save money that is not for immediate use, but not for long-term accounts, such as retirement accounts. Richard Cayne Meyer can help consult on an account for your needs.

In the wary world of the market, money market funds are a popular way to invest your money in a relatively safe way usually for short term. Used by both individuals and businesses, money market accounts are used as a short-term cash management tool. For the most part, money market funds are designed as a short-term investment (less than one year); many accounts mature in 30-90 days. There are some money market accounts designed to save money that is not for immediate use, but not for long-term accounts, such as retirement accounts. Richard Cayne Meyer can help consult on an account for your needs.

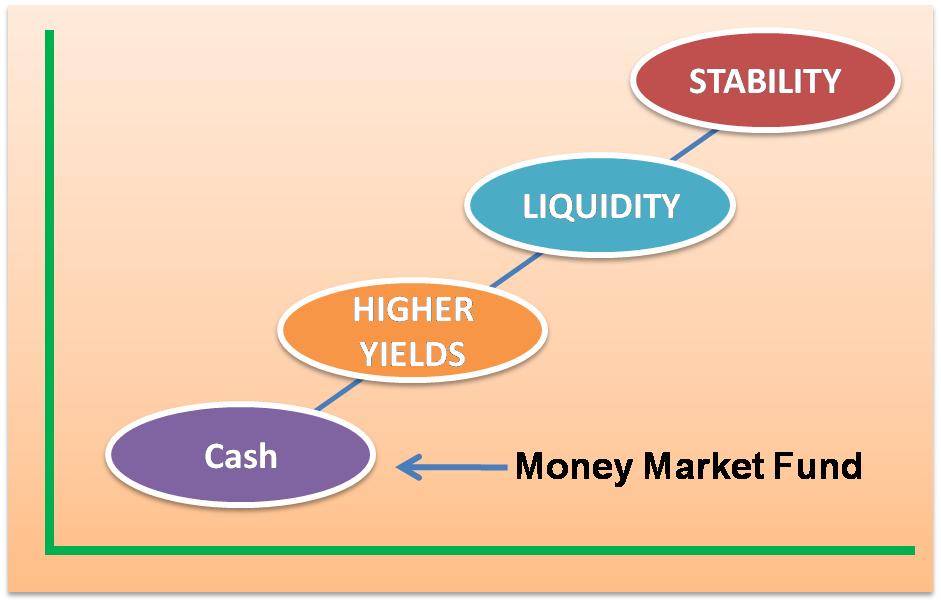

STABILITY

It’s important to understand how money market funds (also known as money market deposit accounts) are set up before investing in one. These funds are actually securities that have been backed to keep the share price at $1 per share. It’s rare that it should dip below that mark; it’s only happened a handful of times since the advent of money market funds in the early 1970s. Richard Cayne Japan mentions one of the advantages of money market funds is that unlike other financial institutions, the $1-per-share price makes it one of the more stable funds to invest in. It’s often considered a safer way to invest your money than in stocks and bonds that fluctuate with the market. And because of this, certificates of deposit (also called CDs), commercial paper, and Treasury bills (also called T-bills) seem more attractive to investors because of its ability to weather minor turbulences in the market. It’s certainly not a guarantee, but it tends to be more stable than other types of accounts according to Richard Cayne Thailand.

LIQUIDITY

To refer to a fund’s or account’s liquidity means its ability to be bought and sold. Certain kinds of funds are not easily sold or traded, perhaps because of the type of account it is, the terms of the account, or that there may not be many people who are willing to invest in a certain type of market. Generally, Richard Cayne Thailand explains money market funds are designed to limit the exposure to the risks of narrow liquidity.

HIGHER YIELDS

In many cases, these money market accounts are preferred over setting up a regular saving account at your bank because money market accounts often yield a higher interest rate. It’s certainly dependent on the type of bank and in some cases, the amount you invest. Different banks and financial institutions offer different rates and types of accounts, so Richard Cayne Meyer advises it’s best to do your due diligence before investing. There are also limitations to the number of times you can withdraw or transfer money out of your account. Money market funds which Richard Cayne Japan can help consult upon may offer several options for saving money with more stability and higher yields.

Richard Cayne Meyer born in Montreal, Quebec Canada resides in Bangkok Thailand and runs the Meyer Group of Companies www.meyerjapan.com Prior to which he was residing in Tokyo Japan for over 15 years and is currently CEO of Asia Wealth Group Holdings Ltd a London, UK Stock Exchange listed Financial Holdings Company. Richard Cayne has been involved in the wealth management space in Tokyo Japan and has assisted many High Net worth Japanese families create innovative international tax and wealth management planning solutions. https://www.isdx.com/Asia Wealth Group