People laugh when they hear the name Big Mac Index, and that might be exactly the reaction the staff at The Economist wanted when they introduced the easy-to-digest (pardon the pun) currency valuation index nearly thirty years ago, in 1986.

The Big Mac Index was designed as an informal way to explain and measure some high-level economic ideas about currency under- and over-valuation. Richard Cayne of Meyer International often uses ideas such as this one when introducing investment theories to first-time investors or others new to economics.

While the ideas behind the Big Mac Index might seem too complicated for your average layperson or new investor, putting the ideas into something small that most people can wrap their head around, makes the ideas easier to understand.

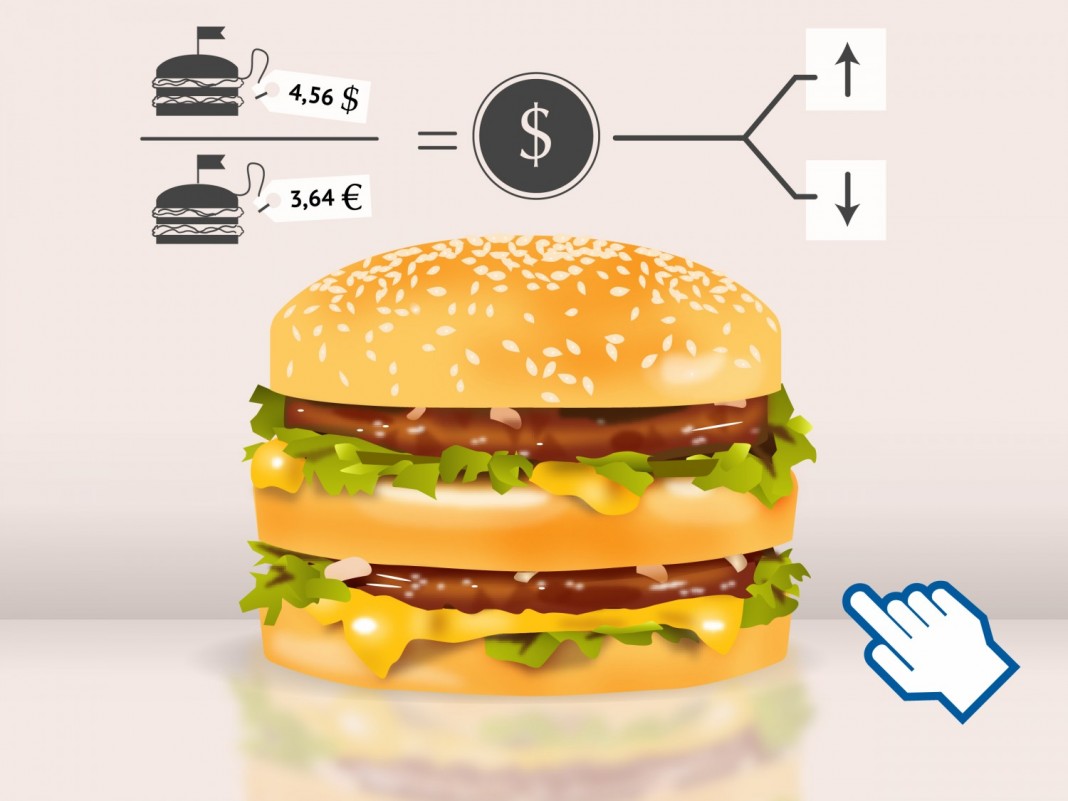

The Index works like this, according to Richard Cayne: by measuring the price of a McDonald’s Big Mac burger in different countries around the world, you can measure the relative values of each country’s currency. The Big Mac Index is, in some ways, an even simpler version of the “Basket of Goods” often used to understand currency values around the world. It’s simpler because it tracks the price of just one item. And it is an item that is easily recognizable and somewhat, but not completely, standard around the world.

In theory, assuming that that burger has the same value around the world, you can figure out an ideal exchange rate by looking at what the burger costs in two countries and dividing one number by the other. For example: If the burger costs $5 in the US and €3 in Italy, than €3 should be more or less equal to $5 US and the exchange rate should be: $1.66 to €1. Then, if you compare those numbers to the actual exchange rate, you can see which currencies are over and undervalued when compared to the US Dollar, which the index is based on.

The concept behind the Big Mac Index is called purchasing power parity (PPP) and it is a way to gauge exchange rates and currency valuations. By looking at the cost of the same goods in different countries and what they cost, you can see how strong each currency is.

Of course, such a simple system has lots of limitations, including: the demand for the burger around the world, the income of people living in the country and how McDonald’s is viewed and the role it plays as a restaurant or meeting place in different places. In this way, the true value of the Big Mac will never be exactly the same in two different countries. Economists have also pointed out that there is no logical reason why the price and value to the same good should be the same in two different countries.

The Big Mac Index is a fascinating concept no matter what you take away from it. Think about that the next time you sit down to a McDonald’s burger. No matter what country you’re in.

For further information about economic theory and investment topics, Richard Cayne and Meyer International can be reached at (+66) 02 611 2561.